Discover the most effective Ways to Boost Your Web Site Traffic

In the vast landscape of electronic advertising, the quest to boost web site traffic stands as a crucial difficulty for companies looking for to increase their on the internet presence. With countless strategies and methods available, critical one of the most reliable strategies can be a daunting job. From the ins and outs of SEO optimization to the nuances of content advertising and marketing, each method provides an one-of-a-kind opportunity for development and visibility. Nevertheless, truth significance of driving web traffic exists not only in utilizing these methods however in recognizing how they link and enhance each other to develop a comprehensive method. As services browse this facility surface, uncovering the most effective techniques that yield concrete outcomes remains a continuous pursuit.

Search Engine Optimization Optimization

To enhance the exposure and position of a website on internet search engine results web pages, executing reliable SEO optimization strategies is vital. SEARCH ENGINE OPTIMIZATION, or search engine optimization, is the practice of maximizing a web site to improve its visibility for appropriate searches. By utilizing numerous techniques such as keyword optimization, producing top quality web content, and improving website speed and user experience, businesses can increase their possibilities of appearing higher in internet search engine results.

One essential aspect of SEO optimization is keyword research study. Identifying the ideal key phrases that prospective site visitors are browsing for can substantially affect a website's position. Integrating these keywords normally into internet site material, meta descriptions, and headings can boost the site's importance to browse engines.

Additionally, maximizing the technical facets of a web site, such as improving website speed, fixing damaged links, and developing a mobile-responsive layout, can improve customer experience and add to better internet search engine rankings. By continually keeping an eye on and adapting search engine optimization techniques, businesses can remain in advance in the affordable on the internet landscape and bring in even more natural website traffic to their web sites.

Material Marketing

Enhancing online existence and audience engagement can be achieved with critical content advertising strategies. Content advertising includes developing and dispersing valuable, appropriate, and constant web content to bring in and retain a clearly defined audience - Website Traffic. By creating high-grade content that resonates with your target market, you can drive web traffic to your internet site, increase brand name recognition, and establish your authority in the industry

One key aspect of content advertising is comprehending your audience's preferences and requirements. Carrying out complete study to recognize the subjects, styles, and networks that attract your target audience can assist you tailor your material technique for maximum effect. Whether it's useful post, involving video clips, or interactive infographics, providing web content that addresses your target market's discomfort points and interests is vital for driving website traffic and cultivating customer loyalty.

Additionally, leveraging social media systems, e-mail advertising, and search engine optimization (SEO) strategies can magnify the reach of your material and drive more website traffic to your web site. By constantly creating valuable and shareable material, you can enhance your online visibility and draw in a larger target market to your site.

Social Media Involvement

Involving with social networks systems is a crucial part of a detailed digital marketing strategy. Social media interaction includes interacting with your target market on different platforms like Facebook, Twitter, Instagram, LinkedIn, and others. By actively joining conversations, sharing valuable web content, and replying to remarks and messages, you can construct a dedicated following and drive web traffic to your web site.

To make best use of social media sites engagement, it's important to tailor your content per system's special characteristics. Usage visually appealing images on Instagram, amusing and succinct messages on Twitter, professional web content on LinkedIn, and interactive videos on Facebook. Involving with your audience in a real and authentic manner is essential to boosting and cultivating relationships brand exposure.

In addition, leveraging social media analytics tools can supply beneficial understandings right into your audience's preferences and behaviors, enabling you to fine-tune your social media sites approach for much better involvement - Website Traffic. By continually monitoring and adapting your technique, you can boost your social media presence and ultimately drive even more website traffic to your internet site

Email Advertising And Marketing Projects

After developing a strong visibility on social media sites systems to engage with your audience and drive website web traffic, the following step in your digital advertising and marketing method includes executing effective Email Marketing Campaigns. Email advertising and marketing stays a powerful device for services to link with their More Info target audience in an extra individualized and direct way. By crafting appropriate and engaging web content, organizations can nurture leads, build partnerships with clients, and drive traffic back to their web sites through purposefully created email projects.

To successfully utilize email advertising and click here for more info marketing for enhanced website traffic, it's important to segment your e-mail list based upon factors like demographics, acquisition history, or involvement degree. This targeted method allows you to customize your messages to particular groups, increasing the likelihood of driving website traffic to your site. In addition, optimizing your e-mail content for mobile devices is necessary, as a considerable section of email opens currently happen on tablet computers and smartphones. By making certain that your e-mails are mobile-friendly, you can engage with a wider audience and drive even more website traffic to your web site properly.

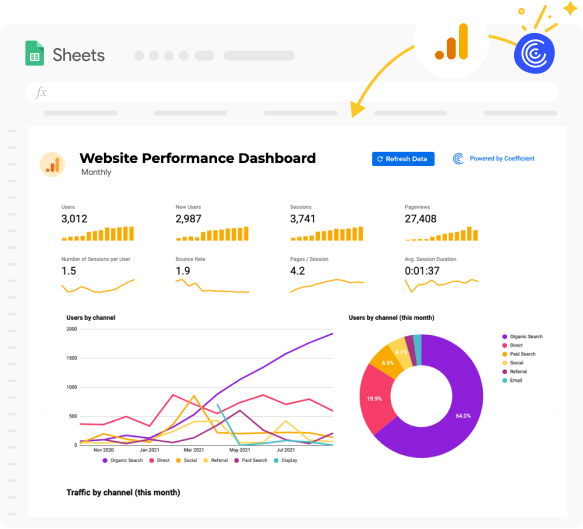

Studying Internet Site Information

An integral aspect of enhancing digital advertising methods and figuring out the efficiency of on the internet projects is the careful analysis of site data. By delving into the metrics provided by devices such as Google Analytics, online marketers can acquire important insights into customer actions, website traffic resources, conversion rates, and much more. This data can introduce patterns, fads, and locations for enhancement, permitting organizations to make enlightened choices to improve their on the internet existence.

Additionally, examining internet site information makes it possible for marketers to recognize their target market much better. By segmenting information based upon demographics, gadgets utilized, or geographical place, services can tailor their material and advertising approaches to accommodate certain target market preferences, ultimately driving even more website traffic and conversions to their web site.

Final Thought

In verdict, implementing approaches such as SEO optimization, web content advertising, social media sites engagement, e-mail advertising and marketing campaigns, and assessing site information can significantly boost web site web traffic. By concentrating on these essential locations, site owners can bring in more site visitors and eventually raise their on-line visibility and reach. Website Traffic. It is essential to continuously keep track of and adjust these techniques to ensure sustained development in internet site web traffic

By creating top notch web content that reverberates with your target market, you can drive traffic to your website, rise brand name understanding, and establish your authority in the industry.

By proactively getting involved in discussions, sharing useful material, and responding to remarks and messages, you can develop a loyal following and drive website traffic to your web site.

After developing a strong visibility on social media systems to engage with your target market and drive web site traffic, the following action in your digital marketing approach includes executing effective Email Advertising and marketing Campaigns. By crafting relevant and engaging web content, services can nurture leads, build partnerships with consumers, visit our website and drive web traffic back to their websites via purposefully created email projects.

In verdict, executing techniques such as SEO optimization, content advertising and marketing, social media interaction, email advertising and marketing projects, and examining site information can considerably enhance website web traffic.